Countdown to Christmas has already begun. It’s that time of the year, which is meant to be more relaxing, enjoyable, and full of pleasant surprises, but where does the other strange feeling come from?

Aaahhh, yes!

Tax season 2023 is approaching.

Peak season pressure of meeting strict deadlines isn’t new for accounting firms. No one can deny that the period from January to April are busiest for accountants. They are required to work 60-80 hours a week, including weekends, to complete tax preparation of 1040, 1041, 990, 1065, 1120, 706, and more… while ensuring client confidentiality, accuracy, and timeliness. However, many accountants work even longer depending upon the complexity and workload.

There are things that are most common in these four months – Irregular Sleep, Restlessness, and Disturbed Work-Life. According to Replicon, Accountants are 50% more likely to be sick before the annual tax deadline.

But why struggle through another tax season when you can counter this seasonal burnout and seamlessly cater to a large number of clients with outsourced tax preparation services.

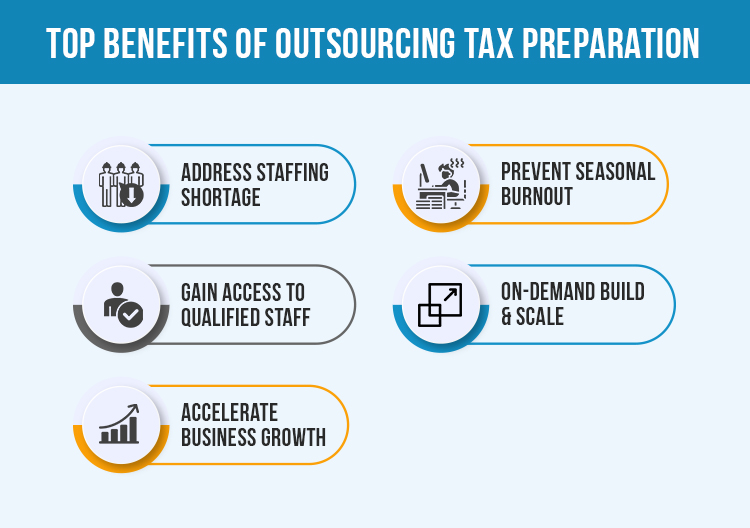

Address Staffing Shortage

If your accounting firm is like most, you struggle with staff shortage while preparing for tax season.

“No Weekend, No Family Time, No Leisure Time

Work, Work, and Work!”

Accountants are always glued to their screen during tax season. There’s a guaranteed chance of compromising the accuracy and quality of the output. Since 2019, accounting firms have been struggling to replace outgoing accountants as they tend to quit their jobs during the peak tax season in the quest of healthier work-life balance.

Bloomberg Tax data shows accountants and auditors decreased by 17 percent from 2019 (its peak) to 2021.

Let’s look at how Outsourcing can help overcome your tax season woes.

Manage with Existing Workforce – In the aftermath of Great Resignation or Reshuffle, Outsourcing Tax Preparation is an obvious and logical alternative to address staffing issues and eliminate/reduce any need to hire resources in-house.

Seamlessly Handle Compliance Overload – With a pool of talent by your side, you can seamlessly manage large volumes of tax preparation. Outsourced tax preparation service providers have expertise in bookkeeping, accounting, tax preparation, and have the ability to work on leading tax and accounting software.

Prevent Seasonal Burnout

Tax preparation is a tedious task. In the US, accountants spend 6.1 billion hours doing taxes each year. On average, an accountant spends 13 hours and $240 to dread the 1040 tango – Source Wallethub.

Mostly, tax preparation gets delayed till the last minute as clients don’t always communicate or share information promptly. Accounting firms constantly chase their clients to retrieve relevant information, further adding unwanted stress on the already existing deadline pressure.

How to Cope with Peak Season Burnout – Demanding tax season and resource crunch create the need for offshore tax preparation experts to avoid burnout.

A marginal error or missed deadline can potentially invite a hefty fine for your clients and also dent your firm’s reputation. However, outsourcing ensures that the work is done with high precision.

“No mistakes. No carry forward. Enabling you to offer priority tax services and within the deadline that everyone is looking for.”

Access to Qualified Staff

Accounting firms deal with a sudden onslaught of all sizes of businesses while being conscious of deadlines. So, suddenly the workweek of the staff shifts from a comfortable work-life balance to a never-ending juggle between heaps of paperwork.

It goes without saying that the workload is extremely high; thus, to scale the operations and meet strict deadlines, you need to increase the internal headcount. Unfortunately, your operational overheads spike due to high salary, fringe benefits, infrastructure, training, onboarding, and more…

According to research, accounting firms spend 70% of their human resources, time, and money on tax preparation.

Offshoring tax preparation can give access to qualified staff, and that too, in your budget. Staffs have the expertise to keep up with the US Tax legislation and changing norms. Thus, you get accurate and timely delivery of work, freeing you to accomplish strategic objectives of your business. Moreover, you will experience cost reduction in hiring, training, maintenance, office supplies, tax and accounting software, and other latest financial tools.

On-Demand Build & Scale

There’s an exponential rise in the workload during tax season, so the accounting firms need to hire seasonal employees to scale their operations. However, once the tax season is over, suddenly the workload is curtailed. Hence, newly hired accountants become redundant, adding the resource cost.

Outsourced tax preparation services help to access talent pool as and when required and scale your practices by avoiding additional increase in overheads.

Accelerate Business Growth

There are complicated tax returns that demand more time and attention. Thus, all your key resources get cannibalized during the peak tax season. But don’t let the workload bog you down, resulting in inaccuracies while carrying out data collection, filling, and calculation. Supplement your in-house staff with outsourced tax preparation services.

That’s right! With quick turnaround, lower operating expenses, and easing burden of tax preparation, accounting firms can grow while ensuring work-life balance during 2023 season and beyond.

From start-ups to established enterprises, tax preparation outsourcing is the best thing to counter tax season workload. It has been helping accounting firms to reduce stress, improve productivity, and grow 2x.

At PABS, you can handle peak season workload while ensuring zero hassles, easy onboarding, quick implementation, and flawless delivery.