Did you know?

The 20-hours long bookkeeping process is now completed in just 15 minutes.

Thanks to the evolution of accounting and bookkeeping that is opening doors for new forms of value creation. At the same time, businesses are rethinking how to optimize accounting operations and achieve excellence.

Many of you may not know that bookkeeping, an age-old profession, has been an integral part of human societies since the inception of the barter system.

The history of accounting and bookkeeping dates back over 7000 years. With the emergence of technology, the practice of bookkeeping has constantly evolved, from rudimentary methods to digital systems. However, the fundamentals are similar.

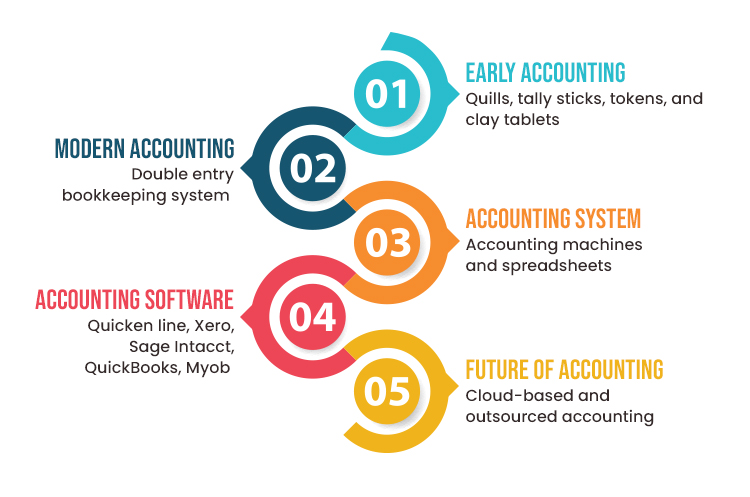

Evolution of Accounting and Bookkeeping

Early Accounting

Over the centuries, merchants exchanged goods and services directly without the use of currency. The agreements were made for the exchange of labor, goods, or services. To maintain transparency and record agreements, bookkeepers employed rudimentary methods such as quills, tally sticks, tokens, and clay tablets.

The merchants who were not good with numbers employed bookkeepers to keep records of what they spent and what they owed – “Keeping Tally” during the Roman Empire. They used early tools like the abacus and alphabetic system to record the agreements and grow true wealth. These records were made in only one column, which was why it was called single-entry bookkeeping.

| Item Details | Amount |

|---|---|

| Blinds | $480.00 |

| Shutter | $465.00 |

| Windows Light | $900.00 |

| Stair Rail | $500.00 |

Similarly, Ancient Egypt and Babylon created the practice of auditing and verifying inventory accuracy.

Modernization

The father of modern bookkeeping, Luca Pacioli first established the “language of business” – Accounting in the late 15th century.

In 1494, Pacioli published a textbook called “Summa de Arithmetical, Geometric, Proportion et Proportionalita,” which included a section on bookkeeping. In this section, he introduced the idea of debit and credit and the creation of the balance sheet. It’s a pivotal milestone as it was the foundation of the double-entry bookkeeping system.

| Item Details | Purchase/Sell | Debit | Credit |

| Tyres | Sell | – | $500.00 |

| Mirrors | Sell | – | $200.00 |

| Grilles | Purchase | $48.00 | – |

| Bumpers | Purchase | $48.00 | – |

| Doors | Purchase | $900.00 | – |

| Tail lights | Sell | – | $900.00 |

| Radiators | Purchase | $900.00 | – |

| Step Bumper | Sell | – | $900.00 |

The double-entry system provided a more accurate and comprehensive view of the financial transactions, enabling businesses to assess their financial health and make informed decisions. However, this picture was only for the owners who hired bookkeepers. Other stakeholders never got to see those records. The advancement in bookkeeping and accounting did not hit a pause here. There are more significant ones after the advent of the Industrial Revolution.

The Rise of Accounting Systems and Spreadsheets

With the increasing complexity of business transactions, specialized journals and ledgers were introduced to categorize different types of financial activities.

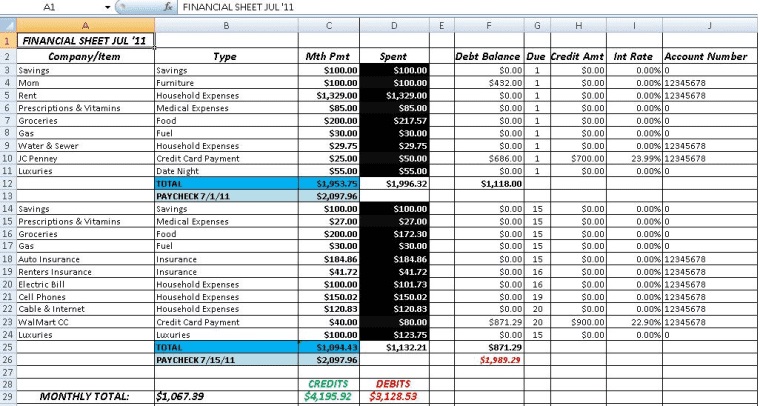

The 20th century witnessed a paradigm shift in accounting & bookkeeping with the introduction of mechanical and electronic devices.

Technology, a transformative force, quietly revolutionized the field of bookkeeping and accounting. It was no longer done with paper and pencil.

Accounting machines, such as the Hollerith machine, automated calculations, and enhanced accuracy. Later, the advent of computers revolutionized the field, allowing for more efficient record-keeping and data processing.

The development of spreadsheets in the 1970s, exemplified by programs like VisiCalc and Lotus 1-2-3, brought a new era of bookkeeping & accounting. Spreadsheets introduced in 1985 enabled accountants to prepare financial statements, reconcile accounts, manage cash flow statements, and more. Analyzing financial data was done more effectively after that, leading to enhanced decision-making capabilities.

To attract investors, enterprises began to release their financials in the form of a balance sheet, income statement, and cash flow statement. These statements were the testimony of business profit-making abilities.

Image Source: Hubpages

Evolution of Accounting: From Spreadsheets to Accounting Software

Did you know?

The first online bookkeeping software was offered by Peachtree in 1981.

Peachtree is an integrated office suite that is a combination of a standard word processor and a spreadsheet. Later in 1983, the Quicken line was launched, which had an easy-to-use interface. From then on, accounting software became an integral part of many large businesses and enterprises.

Many accounting software like Xero, Sage Intacct, QuickBooks, and more became popular in the late 90s for recording day-to-day financial transactions.

With the introduction of accounting software, the speed and security of accounting operations improved drastically. Tokenization made the accounting process more secure.

How?

Tokenization enables converting credit card information into a unique token. This eliminates the chances of unlocking the vault.

Mobile accounting allows business owners to handle a larger portion of their work over the phone, such as issuing invoices and creating expense reports. As a result, they will have more time to analyze, interpret, and forecast financials, helping businesses to grow exponentially.

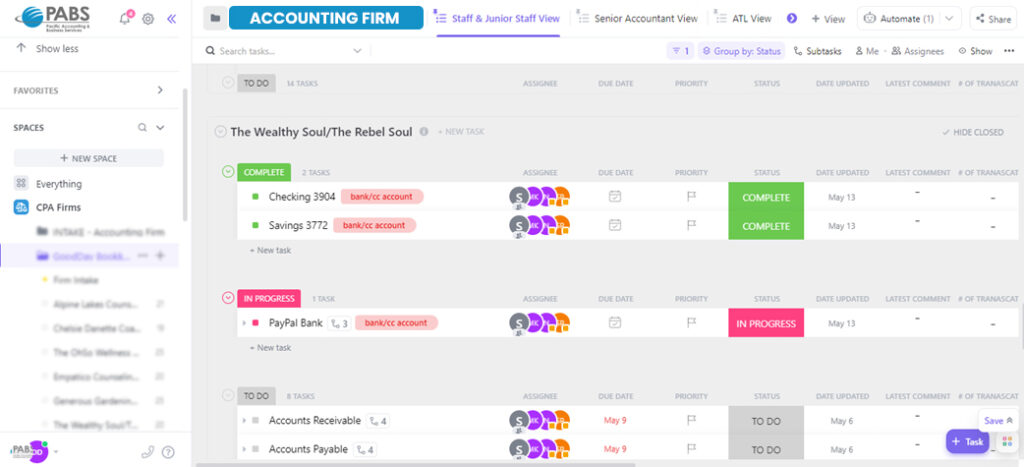

The Future of Accounting: Cloud-Based & Outsourcing

As the speed of evolution increases, so does complexity. Conventional businesses aren’t built for the pace of change today, they need to be future-ready.

We live in two parallel realities: one is cloud accounting and the other is outsourced accounting.

The new paradigm shift combines both.

Today, leading organizations are looking at new ways to simplify accounting operations. The ultimate goal is to drive operational excellence and improve the bottom line. And they’re turning to a cloud-based and successful outsourced accounting model.

Cloud-Based Accounting

Cloud-based accounting is the latest evolution in accounting and bookkeeping. NetLedger, which is now known as NetSuite, was launched in 1999. It aimed at multi-location enterprises and multiple entities, enabling accounting professionals in different locations to work on the same data.

Later Sage 50, QuickBooks desktop, and Xero joined the league.

In 2010, there were only 6 million users of cloud-based applications. By 2020, 78% of small companies were using cloud accounting – According to Accountancy Age

Cloud accounting is the futuristic era for accountants, bookkeepers, CPAs, and financial advisors alike.

However, the new paradigm shift towards outsourced accounting is reshaping the accounting landscape.

Outsourced Accounting

These days, businesses of all sizes embrace the strategic advantages of switching to outsourced accounting services. Let’s dive right in to discover these strategic advantages.

Outsourcing accounting allows businesses to tap into specialized expertise without the need for in-house hiring and training, ensuring access to certified professionals. It reduces overhead costs associated with maintaining an internal accounting department, including salaries, benefits, and infrastructure.

Business owners can save valuable time by focusing on high-value tasks like acquiring new customers, optimizing daily operations, managing employees, strategic planning, and networking that maximizes profits and productivity.

Technological advancements have drastically changed accounting operations, from 13-columned, manually prepared documents to accounting software, and finally the unprecedented shift to outsourced accounting.

Summary

Throughout this remarkable journey, bookkeeping has empowered businesses with accurate financial records, enabling them to make informed decisions, plan strategies, and achieve sustainable growth. In the modern era of bookkeeping and accounting cloud-based and outsourced accounting has liberated accountants from mundane tasks, allowing them to focus on strategic objectives and advisory services.

This evolution of accounting and bookkeeping is a testament to human ingenuity. However, its continued advancement will play a pivotal role in unraveling new possibilities, reshaping the world of finance, and empowering businesses to write their own success stories.